An Individual Taxpayer Identification Number (ITIN) is a nine-digit number that identifies American citizens, residents, and non-residents. You may need one if you work in the United States or have a child who’s eligible for the child tax credit. Here are some reasons why obtaining an ITIN can make life easier for you as an American living abroad:

It’s easier to open a U.S. bank account.

- You can open a U.S. bank account with an ITIN.

- You can open a U.S. bank account even if you don’t have a social security number or credit history, or if you’re working and earning money through cash payments (in which case, your employer’s name will appear on your W-2 form).

- If you don’t have employment in the U.S., there’s no reason not to apply for an ITIN so that you’re able to get access to financial services and manage your finances from afar—especially if it means avoiding high fees from other banks!

You can file taxes jointly with a spouse.

You can file taxes jointly with a spouse. By filing jointly, you and your spouse will have to pay more taxes than if you filed as individuals. However, the average amount of tax paid by married couples is much lower than that of single taxpayers, so it may work out in your favor. Additionally, if one spouse has had a good year while the other has had a bad year, they can help each other out by filing jointly so that they both get their income smoothed over into one number instead of two separate ones.

If both spouses have had equally successful years then it will probably be better for them to file independently and save some money on their tax returns because when you file jointly it lowers how much money each person gets back from Uncle Sam; however, if one person earns significantly more than the other then this method could actually result in less money coming back from Uncle Sam because the IRS takes away some money from each person depending on what percentage of household income belongs to whom before handing out refunds or credits (tax credits are essentially free money given back).

Filing taxes is mandatory when you work in the United States.

While it’s true that you only need to file taxes if you have a job, that doesn’t necessarily mean that filing your taxes is simple. As part of the US tax code, all individuals are required to file annual income taxes and pay the appropriate fees. There are several different ways you can do this:

- A tax preparer can help with filing your return.

- Using tax software like TurboTax or H&R Block will make preparing your return easier.

- You could use an individual taxpayer identification number (ITIN) if you’re not eligible for a social security number (SSN).

The application process is straightforward and free of charge.

An ITIN is easy to obtain, and the application process doesn’t cost you anything.

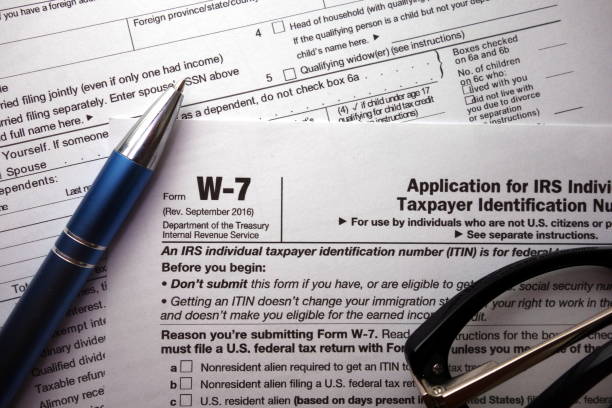

You can apply for an ITIN by mail or online; if you choose to do so by mail, simply complete Form W-7 with all requested information and mail it to the address specified on the form. If you prefer to apply electronically, submit your completed W-7 Form electronically.

An ITIN gives you instant access to tax credits and deductions.

An ITIN will give you instant access to tax credits and deductions that you would otherwise miss out on, as well as the ability to file a tax return. The IRS issues ITINs for individuals who are not eligible for a Social Security number. For example, if you’re a nonresident alien or resident alien but don’t have an SSN, the IRS will issue an ITIN in place of your SSN.

If your employer has already filed taxes on your behalf and used an incorrect Social Security number (SSN) instead of an Individual Taxpayer Identification Number (ITIN), they must amend their mistakes before April 15th so that they do not get charged with penalties by the IRS.

An ITIN makes it easier to buy a home or rent an apartment.

If you live in the U.S., chances are you’re going to need an ITIN at some point or another. Whether it’s to rent an apartment, buy a house, or even get a business license—you can use your ITIN for all of these purposes.

If you want to purchase something like a car but don’t have the financial means to buy one outright yet, sometimes banks will allow people with good credit scores (which may make them eligible for loans) to finance their cars through them instead of having them pay cash upfront.

However, since most banks require proof of identification before they give out any money under any circumstance (lest they get into legal trouble for approving loans), obtaining an ITIN is usually necessary if someone doesn’t have a social security number or other official documentation that proves their identity and residence within the United States.

You need an ITIN to apply for a driver’s license in most states.

An ITIN is the same as a tax identification number, but it’s not the same as a social security number. An ITIN is issued by the federal government to individuals who are ineligible for social security numbers.

An individual can only have one ITIN, which means that if you already have an ITIN, you cannot obtain another one. The IRS issues an ITIN to people who are not eligible for Social Security Numbers (SSN). The IRS does this because these individuals need to report their income and pay taxes on it; however, they cannot file their tax returns using SSNs since they do not qualify for them due to citizenship status or other reasons.

An individual taxpayer identification number helps make life easier in the United States, whether you’re here temporarily or permanently.

An individual taxpayer identification number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are not eligible to obtain an SSN but have taxes withheld and report income on their U.S. tax return.

It’s used to file taxes and claim certain tax credits, such as the Earned Income Tax Credit (EITC). An ITIN can be obtained by filing Form W-7 with the IRS. Once you have an ITIN, you can start using it right away for things like paying your taxes or applying for benefits like medical insurance through healthcare.gov

Conclusion

I hope this information has been helpful if you’re applying for an ITIN. If you are looking for someone to help you file your application and receive the ITIN, you’ve come to the right place.

Micahguru Formation helps non-US residents start their businesses in the United States. We have an IRS Acceptance Agent who can process your ITIN application, reducing the risk of rejection.